ALPHABrotherHai

Ride with the trend, accompany with profit.

ALPHABrotherHai

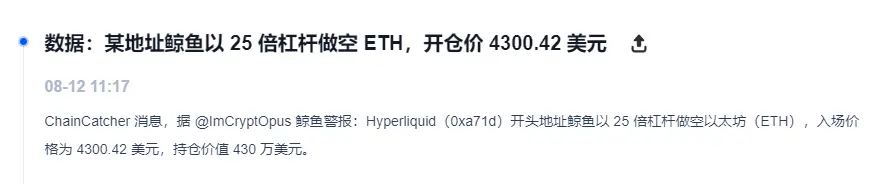

ETH Hourly Cycle Analysis

Conclusion: ETH continues to build a center, consolidating sideways, and can start at any time.

Price Trend Analysis

K-line pattern:

In the last hour, the K-line was blocked and fell back at the 4300 round number, forming an upper shadow. After a breakout with increased volume at the 4275 resistance level in the previous hour, it failed to continue rising.

The daily chart shows a pattern of three consecutive bearish candles, which is a normal technical pullback following the long bullish candle (+260 points) on August 20, with key support at the previous low of 4220.

View OriginalConclusion: ETH continues to build a center, consolidating sideways, and can start at any time.

Price Trend Analysis

K-line pattern:

In the last hour, the K-line was blocked and fell back at the 4300 round number, forming an upper shadow. After a breakout with increased volume at the 4275 resistance level in the previous hour, it failed to continue rising.

The daily chart shows a pattern of three consecutive bearish candles, which is a normal technical pullback following the long bullish candle (+260 points) on August 20, with key support at the previous low of 4220.

- Reward

- like

- Comment

- Repost

- Share

ETH Hourly Trend Analysis

K-line pattern:

Daily level: Recently, the price quickly rebounded from a low of 4056 to a high of 4375 and then retreated, forming a long upper shadow inverted hammer pattern, suggesting strong resistance above 4300. Hourly level: The current price is fluctuating narrowly around 4290, forming a short-term range of 4282-4320.

Technical Indicators:

MACD: 1-hour level DIF ( 23.18) crosses below DEA ( 27.87), histogram turns negative ( -9.38), daily MACD double lines are declining but still above the zero axis. RSI: 1-hour RSI ( 52.02) is flat in the neutral zone, daily

K-line pattern:

Daily level: Recently, the price quickly rebounded from a low of 4056 to a high of 4375 and then retreated, forming a long upper shadow inverted hammer pattern, suggesting strong resistance above 4300. Hourly level: The current price is fluctuating narrowly around 4290, forming a short-term range of 4282-4320.

Technical Indicators:

MACD: 1-hour level DIF ( 23.18) crosses below DEA ( 27.87), histogram turns negative ( -9.38), daily MACD double lines are declining but still above the zero axis. RSI: 1-hour RSI ( 52.02) is flat in the neutral zone, daily

ETH13.12%

- Reward

- 5

- 6

- Repost

- Share

Cho1919 :

:

Hello, ladies and gentlemen. It's nice to meet you. The upcoming US Federal Reserve's Powell will be making an appearance. Volatility is likely to be extremely high. I believe Bitcoin is currently on the verge of cardiac arrest. I encourage everyone to think carefully before investing. Fighting!!!!!View More

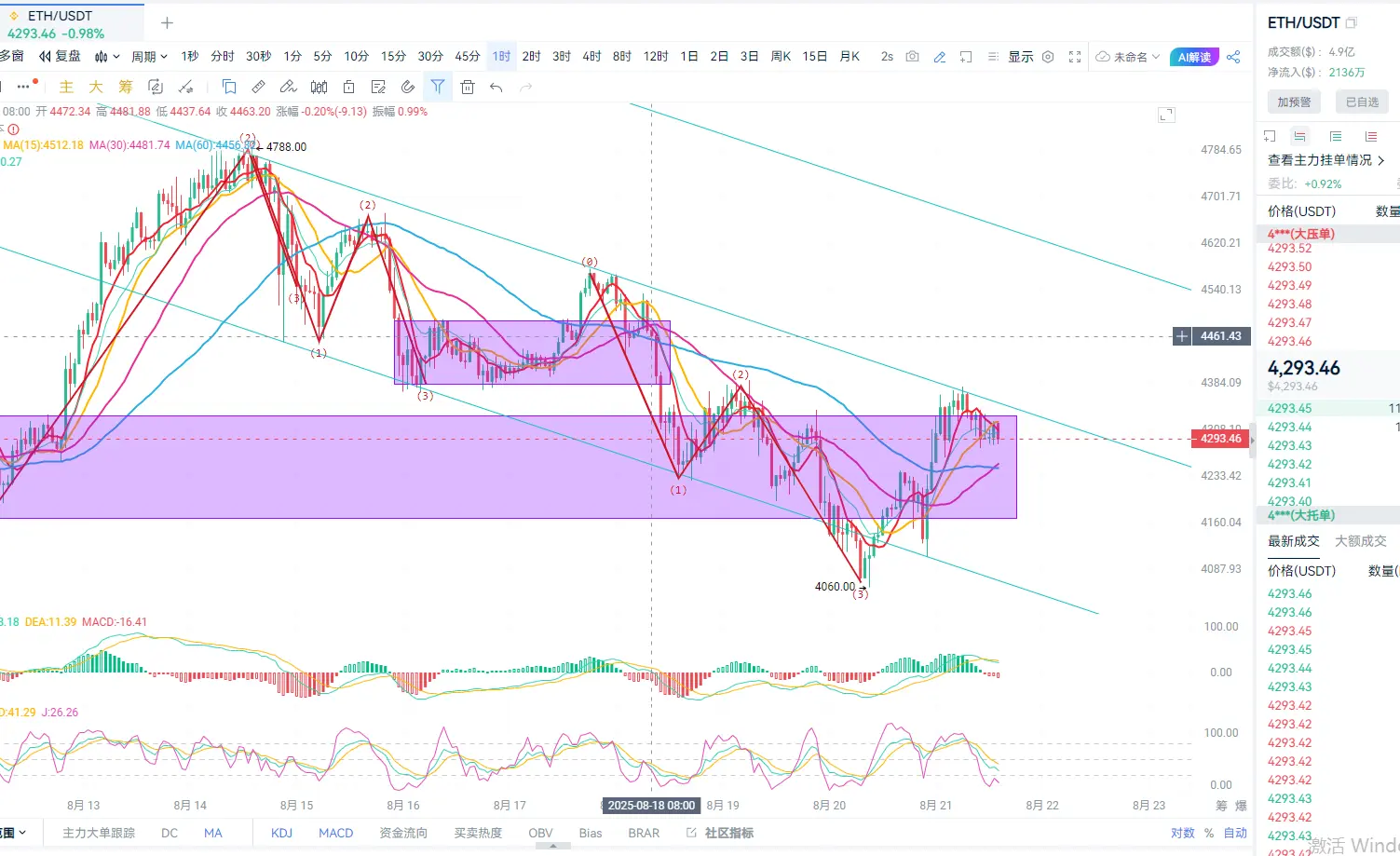

Is the ETH hourly cycle building a downward center?

Price Trend Analysis

K-line pattern:

1-hour level: Recently formed a double bottom structure (4060/4067), rebounding to 4188 after breaking through the neckline at 4130, but facing resistance at the 4200 round number.

Daily level: After the large bearish candlestick on August 19 (4355→4067), a long lower shadow appeared, indicating a rebound of bulls after the selling pressure has been released, but the closing price still remained below EMA7 (4278).

Technical Indicators:

MACD: The DIF on the 1-hour level has crossed above the DEA forming a g

Price Trend Analysis

K-line pattern:

1-hour level: Recently formed a double bottom structure (4060/4067), rebounding to 4188 after breaking through the neckline at 4130, but facing resistance at the 4200 round number.

Daily level: After the large bearish candlestick on August 19 (4355→4067), a long lower shadow appeared, indicating a rebound of bulls after the selling pressure has been released, but the closing price still remained below EMA7 (4278).

Technical Indicators:

MACD: The DIF on the 1-hour level has crossed above the DEA forming a g

ETH13.12%

- Reward

- 7

- 8

- Repost

- Share

BrotherSuWillHelpYou :

:

Buckle up and hold on tight, we're about to To da moon 🛫View More

Conclusion: ETH continues to fall, focus on 4180 support.

[Price Trend Analysis]

K-line pattern:

On the 1-hour level, a series of bearish candlesticks has broken below the key level of 4300, forming a short-term downtrend. The latest candlestick's lower shadow touched 4310 before rebounding, indicating that there is buying support at the integer level.

On the daily chart, the long upper shadow bullish candle on August 17 (4576→4472), combined with the next day's large bearish candle, confirms the top pressure, forming a dark cloud cover pattern.

Technical Indicators:

MACD: The 1-hour level DIF

[Price Trend Analysis]

K-line pattern:

On the 1-hour level, a series of bearish candlesticks has broken below the key level of 4300, forming a short-term downtrend. The latest candlestick's lower shadow touched 4310 before rebounding, indicating that there is buying support at the integer level.

On the daily chart, the long upper shadow bullish candle on August 17 (4576→4472), combined with the next day's large bearish candle, confirms the top pressure, forming a dark cloud cover pattern.

Technical Indicators:

MACD: The 1-hour level DIF

ETH13.12%

- Reward

- like

- Comment

- Repost

- Share

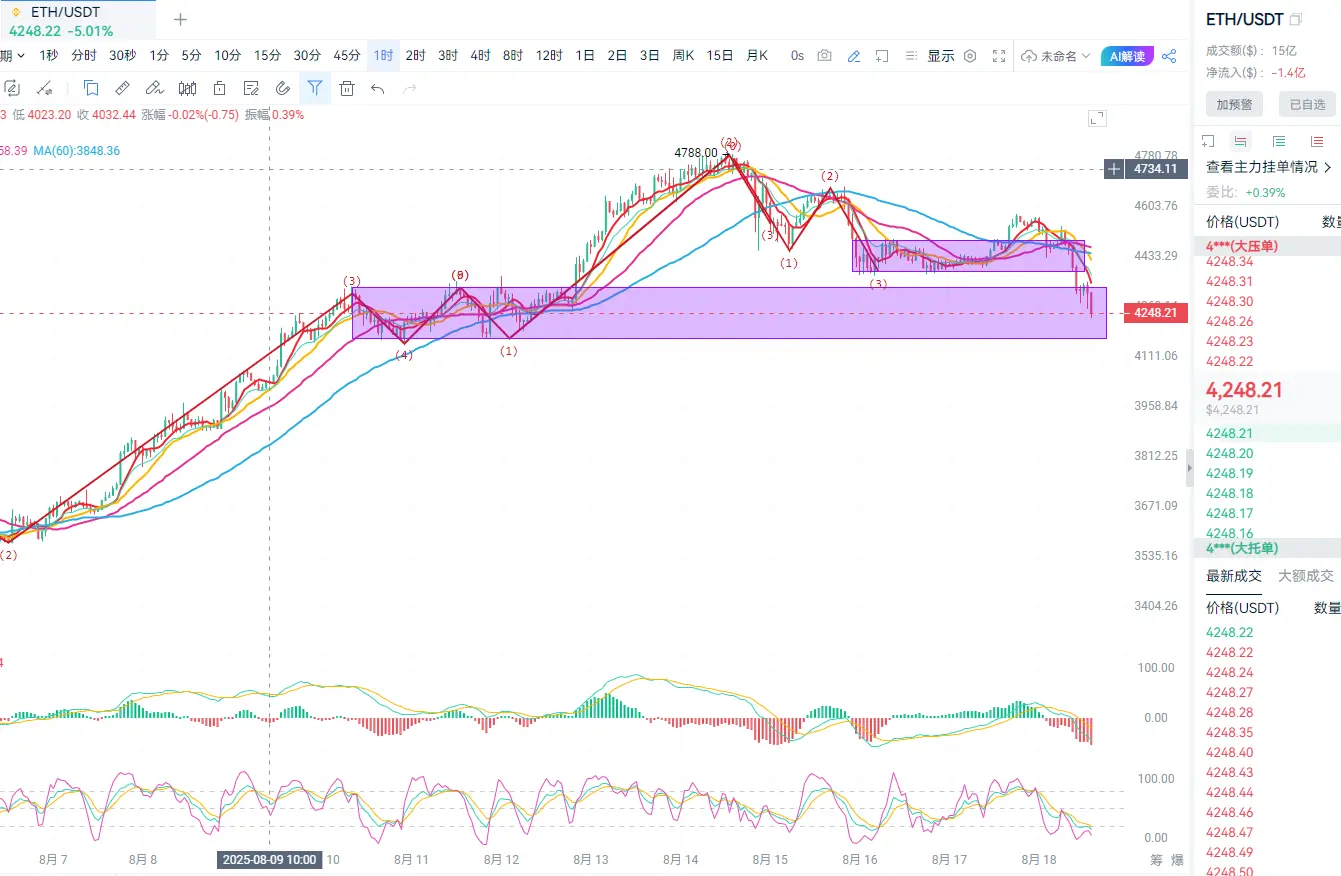

Conclusion: Recently, after reaching new highs for ETH, there has been a rapid pullback, with a central structure being formed in the hourly cycle. The oscillation range is 4360-4500. Within this range, buy low, sell high; if the range is broken, follow the trend. The strategy is to go long near 4360, with a target of 4500.

Short near 4500, target 4360

Price Trend Analysis

K-line pattern:

1-hour level: Recently, a long lower shadow (4368-4433) appeared, indicating bottom buying support, but the subsequent rebound was hindered in the 4450-4500 range, forming a local consolidation.

Daily level:

Short near 4500, target 4360

Price Trend Analysis

K-line pattern:

1-hour level: Recently, a long lower shadow (4368-4433) appeared, indicating bottom buying support, but the subsequent rebound was hindered in the 4450-4500 range, forming a local consolidation.

Daily level:

ETH13.12%

- Reward

- 6

- Comment

- Repost

- Share

- Reward

- 1

- 1

- Repost

- Share

PeopleSomething :

:

good brother Strategy One: [High Sell - Conservative Type]

Entry Area: 4723.72 USDT

Stop loss price: 4805 USDT

Target Area: 4602.51 USDT

Strategy basis: Given that the current market is in a low volatility range and is oscillating, and the price is approaching a strong resistance level of 4786.54, forming a evening star pattern with a bearish divergence in volume and price, adopting a robust strategy of selling high near the resistance level is a reasonable choice that aligns with the current market structure.

1. Overall Analysis and Assessment Currently, the ETH market is in a low volatility range-bound s

Entry Area: 4723.72 USDT

Stop loss price: 4805 USDT

Target Area: 4602.51 USDT

Strategy basis: Given that the current market is in a low volatility range and is oscillating, and the price is approaching a strong resistance level of 4786.54, forming a evening star pattern with a bearish divergence in volume and price, adopting a robust strategy of selling high near the resistance level is a reasonable choice that aligns with the current market structure.

1. Overall Analysis and Assessment Currently, the ETH market is in a low volatility range-bound s

ETH13.12%

- Reward

- 3

- 1

- Repost

- Share

- Reward

- 1

- 4

- Repost

- Share

ComeOnce :

:

Hold on tight, we are about to To da moon 🛫View More

eth hourly Candlestick analysis

Conclusion: The hourly period is in a high-level range of fluctuations. Within the range, sell high and buy low, and follow the trend if the range is broken. The fluctuation range is 4220-4300.

Long Strategy

Buy Point 1: 4250 USDT (integer support level, combined with 1-hour EMA30 support near 4256, and the previous low of 4219 forming a buying opportunity) Buy Point 2: 4220 USDT (integer level, 1.1% away from Buy Point 1, close to the low of 4214.7 on August 12 at 07:00) Long Stop Loss Point: 4190 USDT (below the previous swing low of 4190, stop loss distance o

Conclusion: The hourly period is in a high-level range of fluctuations. Within the range, sell high and buy low, and follow the trend if the range is broken. The fluctuation range is 4220-4300.

Long Strategy

Buy Point 1: 4250 USDT (integer support level, combined with 1-hour EMA30 support near 4256, and the previous low of 4219 forming a buying opportunity) Buy Point 2: 4220 USDT (integer level, 1.1% away from Buy Point 1, close to the low of 4214.7 on August 12 at 07:00) Long Stop Loss Point: 4190 USDT (below the previous swing low of 4190, stop loss distance o

ETH13.12%

- Reward

- 4

- 2

- Repost

- Share

GateUser-ac407fc9 :

:

Global recognition with 2.3 billion reads! PIJS has won the ChainCatcher silver medal, marking our emergence as an undeniable force in the Decentralized Finance space. Next stop, the stars and the sea!View More

ETH hourly cycle pullback

Strategy: Short at 4300-4315, stop loss above 4330, targets 4250, 4150, 4000.

Core viewpoint summary: Currently, the market ETH is in a [range oscillation].

Technical core drivers: The price is close to the strong resistance level of 3864.49, moving averages are in a bullish arrangement, but trading volume has severely shrunk, creating a divergence between price and volume.

External Environment Impact: Market sentiment is neutral, with no significant pressure or positive factors in the macro environment, and mixed news.

Main potential risks: The trading volume is sign

Strategy: Short at 4300-4315, stop loss above 4330, targets 4250, 4150, 4000.

Core viewpoint summary: Currently, the market ETH is in a [range oscillation].

Technical core drivers: The price is close to the strong resistance level of 3864.49, moving averages are in a bullish arrangement, but trading volume has severely shrunk, creating a divergence between price and volume.

External Environment Impact: Market sentiment is neutral, with no significant pressure or positive factors in the macro environment, and mixed news.

Main potential risks: The trading volume is sign

ETH13.12%

- Reward

- like

- 2

- Repost

- Share

ALPHABrotherHai :

:

The first target point has been achieved. Next, let's look at the second target point.View More

- Reward

- like

- 1

- Repost

- Share

LittleBoss :

:

Open the pattern, directly 5000Conclusion: BTC 30M level pullback, short at 116600, target 115500, target 112000

Core viewpoint summary: The current market BTC is in a [downward trend].

Technical core drivers: The evening star pattern and the death cross of moving averages create a bearish resonance, with a clear downward trend in the short term.

External environmental influences: Market sentiment is neutral, the macro environment shows no significant pressure, and news is mixed with both positive and negative factors.

Main potential risks: Extremely reduced trading volume, insufficient market momentum, and the possibility

Core viewpoint summary: The current market BTC is in a [downward trend].

Technical core drivers: The evening star pattern and the death cross of moving averages create a bearish resonance, with a clear downward trend in the short term.

External environmental influences: Market sentiment is neutral, the macro environment shows no significant pressure, and news is mixed with both positive and negative factors.

Main potential risks: Extremely reduced trading volume, insufficient market momentum, and the possibility

BTC3.75%

- Reward

- 2

- Comment

- Repost

- Share

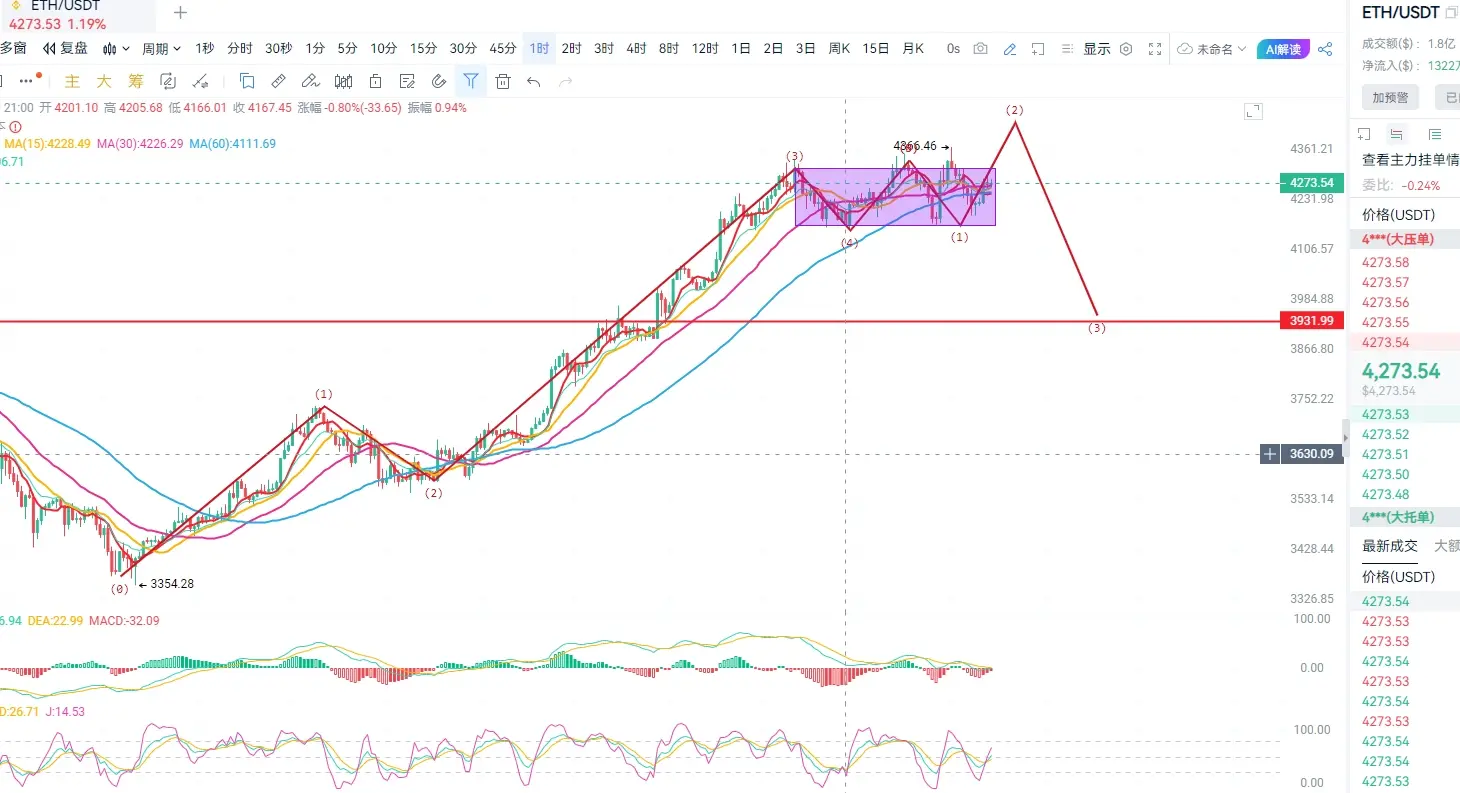

ETH short order position 3900 target 3750

Long order position 3730 target 3930

Summary of Key Points: The current market for ETH is in a [neutral sideways] position.

Technical core drivers: ETH price is approaching a strong resistance level of 3937. Although the trend remains bullish, the trading volume has drastically decreased, increasing the risk of a pullback.

External environmental impact: The overall external environment is neutral, market sentiment has not provided a clear direction, and news is mixed with bullish and bearish signals.

Main potential risk: If the price fails to break thr

Long order position 3730 target 3930

Summary of Key Points: The current market for ETH is in a [neutral sideways] position.

Technical core drivers: ETH price is approaching a strong resistance level of 3937. Although the trend remains bullish, the trading volume has drastically decreased, increasing the risk of a pullback.

External environmental impact: The overall external environment is neutral, market sentiment has not provided a clear direction, and news is mixed with bullish and bearish signals.

Main potential risk: If the price fails to break thr

ETH13.12%

- Reward

- 4

- 3

- Repost

- Share

WealthAndFortuneFlowIntoThe :

:

That's impressive! Just making my presence felt, completing a task, and hitting a word count should be enough, right?View More

ETH Hourly K-line Interpretation

Core view summary: The current market ETH is in a 【range oscillation】.

Technical core drivers: The price is between the strong support at 3662.83 and the strong resistance at 3747.23, with low market volatility, entangled moving averages, and weakening momentum, forming a consolidation pattern.

External environment impact: Market sentiment is neutral, macro pressure is limited, and the news is mixed.

Main potential risks: Extremely low trading volume leads to unhealthy price-volume relationships, and the evening star pattern may trigger a bearish reversal.

1. O

View OriginalCore view summary: The current market ETH is in a 【range oscillation】.

Technical core drivers: The price is between the strong support at 3662.83 and the strong resistance at 3747.23, with low market volatility, entangled moving averages, and weakening momentum, forming a consolidation pattern.

External environment impact: Market sentiment is neutral, macro pressure is limited, and the news is mixed.

Main potential risks: Extremely low trading volume leads to unhealthy price-volume relationships, and the evening star pattern may trigger a bearish reversal.

1. O

- Reward

- 1

- 3

- 1

- Share

GateUser-258fa3f1 :

:

Just go for it💪View More

BTC 4-hour cycle K-line interpretation!!

Core View Summary: The current market BTC is in a 【downtrend】.

Technical core drivers: The three black crows pattern is significant, with moving averages in a bearish arrangement and a death cross forming a bearish resonance, both trend and momentum indicate a downward direction.

External environmental impact: The overall external environment is neutral, and market sentiment has not provided a clear direction, with mixed news.

Main potential risk: The current price is close to the strong support level of 111754.43, which may limit further price declines

Core View Summary: The current market BTC is in a 【downtrend】.

Technical core drivers: The three black crows pattern is significant, with moving averages in a bearish arrangement and a death cross forming a bearish resonance, both trend and momentum indicate a downward direction.

External environmental impact: The overall external environment is neutral, and market sentiment has not provided a clear direction, with mixed news.

Main potential risk: The current price is close to the strong support level of 111754.43, which may limit further price declines

BTC3.75%

- Reward

- 4

- 5

- Repost

- Share

MasterNiu :

:

How to add you as a friendView More

Core Summary of Key Points

The current market ETH is in a 【downward trend】.

Technical core drivers: Extremely low trading volume and price below VWAP create a volume-price divergence, indicating insufficient market momentum.

External Environment Impact: Market sentiment is neutral, there is no significant pressure in the macro environment, and the news is mixed.

Main potential risks: BOLL and RSI indicators show a balanced market sentiment, normal volatility, which may limit the downside potential.

I. Overall Analysis and Judgment

ETH/USDT shows a clear downtrend on the 4-hour chart, with a ke

View OriginalThe current market ETH is in a 【downward trend】.

Technical core drivers: Extremely low trading volume and price below VWAP create a volume-price divergence, indicating insufficient market momentum.

External Environment Impact: Market sentiment is neutral, there is no significant pressure in the macro environment, and the news is mixed.

Main potential risks: BOLL and RSI indicators show a balanced market sentiment, normal volatility, which may limit the downside potential.

I. Overall Analysis and Judgment

ETH/USDT shows a clear downtrend on the 4-hour chart, with a ke

- Reward

- 1

- Comment

- Repost

- Share

ETH 4-hour candlestick analysis!

Core viewpoint summary: Currently, the market ETH is in a [ambiguous trend].

Technical core drivers: The price has broken through the short-term moving average accompanied by an increase in MACD momentum and a bullish engulfing pattern, indicating signs of a short-term rebound, but the extremely low trading volume limits the sustainability of the rise.

External environmental impact: Market sentiment is neutral, with no significant pressure or benefits in the macro environment, and mixed news.

Main potential risks: Insufficient trading volume leads to a lack of

View OriginalCore viewpoint summary: Currently, the market ETH is in a [ambiguous trend].

Technical core drivers: The price has broken through the short-term moving average accompanied by an increase in MACD momentum and a bullish engulfing pattern, indicating signs of a short-term rebound, but the extremely low trading volume limits the sustainability of the rise.

External environmental impact: Market sentiment is neutral, with no significant pressure or benefits in the macro environment, and mixed news.

Main potential risks: Insufficient trading volume leads to a lack of

- Reward

- like

- 1

- Repost

- Share

GateUser-725e6ae7 :

:

666666BTC 4-hour Candlestick Interpretation

The current market BTC is in a [range oscillation]. Technical core drivers: the price is between key support level and resistance level, with the resistance level forming significant suppression. At the same time, divergence between volume and price and a bearish engulfing pattern suggest pullback risks. * **External environment impact**: Market sentiment is neutral, macro environment pressure is limited, and news is mixed, overall impact is slightly neutral. * **Main potential risks**: Insufficient upward momentum may lead to the price potentially pulling back to the support level.

BTC3.75%

- Reward

- like

- Comment

- Repost

- Share