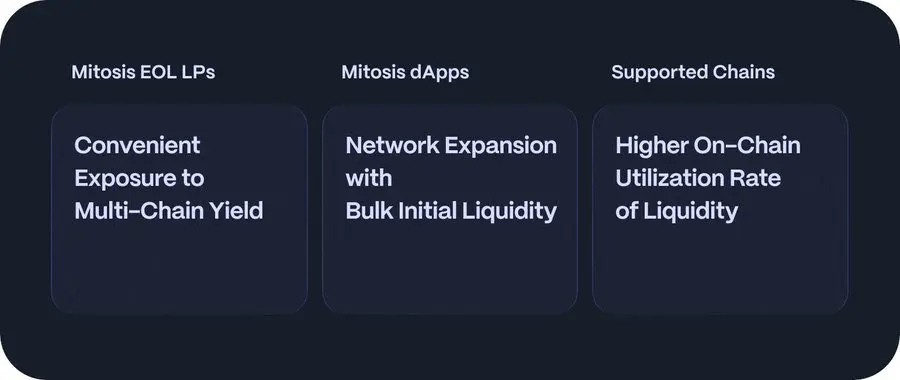

Mitosis turns liquidity allocation into a public market!

Why do you say that? In Mitosis:

Want liquidity for your dApp? Now it depends on strength; whoever can provide better returns for LPs and has a good reputation will attract votes!

LP holding miAssets can choose those with high returns? Safe? Good experience? Select at will!

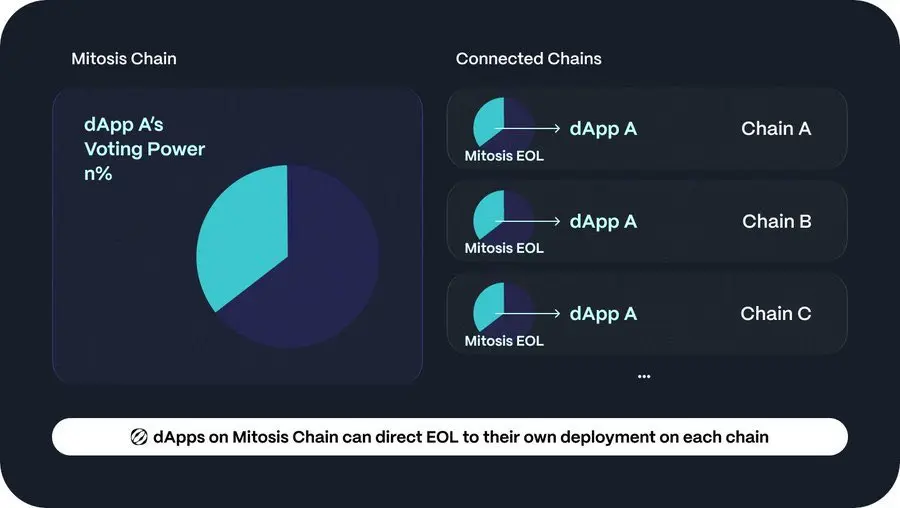

For example, Aave can directly say when opening a new market on Scroll:

Delegate the ticket to me, and I will share the profits from your side.

If LP thinks it's worthwhile, just cast your vote. This is completely different from the past, where agreements were made be

View OriginalWhy do you say that? In Mitosis:

Want liquidity for your dApp? Now it depends on strength; whoever can provide better returns for LPs and has a good reputation will attract votes!

LP holding miAssets can choose those with high returns? Safe? Good experience? Select at will!

For example, Aave can directly say when opening a new market on Scroll:

Delegate the ticket to me, and I will share the profits from your side.

If LP thinks it's worthwhile, just cast your vote. This is completely different from the past, where agreements were made be